March 20, 2021 Tax Tips

Sometimes it feels like tax season just sneaks up, and it’s already that time of year again! Thursday, April 15th is approaching quickly, and we wanted to help you prepare the best you can with a few tips and bits of information.

The IRS recommends taxpayers file electronically to receive their refund the quickest. They also recommend checking IRS.gov as they are frequently updating the latest tax information. This will help you avoid long hold times calling the IRS by finding many of your questions and answers right on their website1.

A few tax updates to keep in mind:

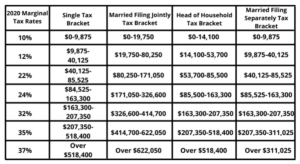

The standard deduction for 2020 has increased to $12,400 for single filers and to $24,800 for married couples filing jointly. Income brackets have also increased to account for inflatio2.

Income rates and tax brackets have also shifted as shown in the image below3.

Charitable Contributions:

The CARES Act allows you to deduct up to 100% of your total income minus all other deductions you’ve taken in qualified charitable donations. It will also allow you to write off up to $300 worth of charitable contributions that were made in cash4.

529 or Educational Savings Accounts (ESA):

Are tax-free if used for qualified educational expenses; however, since many schools went remote, you may have been refunded some if not all money that came from your 529 or ESA account. If you were refunded, there is a 60-day leeway period to put the money back in the account or use it for other educational expenses (pay off up to $10,000 in student loan debt, books, fees or other supplies)5. If the money was not put back in the account, there is a chance you may have to pay a withdrawal penalty as well as income tax6.

Retirement Plans: 401k’s and IRA’s

The CARES Act allowed for those who are under age 59 ½ in age to take up to $100,000 out of their IRA’s and 401k’s through the end of 2020 without an early withdrawal penalty; however, anything taken out of those accounts may be taxed as ordinary income7. Taxes are required on funds taken out of a 401k, but you have 3 years to put the money back into your account and receive a refund on taxes paid8. The required minimum distribution through 2020 was forgiven without a penalty on IRA accounts, and the age required to take the required minimum distribution was changed from 70 ½ to 72.

Last year was a strange year, and there were a lot of new things put into effect. If you have any questions or concerns, please reach out to us at 801-465-6990.

1 https://www.irs.gov/newsroom/2021-tax-filing-season-set-to-begin-february-12

2 https://www.daveramsey.com/blog/tax-season-what-you-need-to-know

3 https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2020

5 https://www.irs.gov/forms-pubs/about-publication-970

6 https://www.irs.gov/taxtopics/tc313