November 13, 2021 Cryptocurrency

Everywhere you go, people are talking about cryptocurrency and the gains or losses they’ve made with it. The type of cryptocurrency I hear about the most from my kids is Dogecoin, they talk about it all the time! So, what is cryptocurrency?

With cryptocurrency, there are no financial intermediaries, like banks, currency exchanges or government. Crypto currency is the opposite of hard cash, things like paper dollars and metal coins, or precious metals that are tangible. Cryptocurrency is more of a soft currency, like credit cards, bank loans, stock shares, etc.

Cryptocurrency is dependent on blockchain technology to track and verify it’s ownership. Blockchain technology is a type of digital ledger and securely records all transactions that everyone can see, but no one can change.

One way to understand cryptocurrency is to compare it to title insurance. When you buy a house, you hire a title company to see if there are any active claims on the property, then pay for an insurance policy against future claims. This investigation and insurance fee is generally conducted every time a house is sold.

However, if title changes were recorded via blockchain technology, the registration would be absolute and visible on the blockchain ledger, and there would be no reason to pay for research and title insurance each time the house changed ownership.

Over the last ten years, Bitcoin (a type of cryptocurrency) has had a 300% annualized return. When compared to annualized returns of more traditional assets, such as the stock market (10% Avg. annualized return) and bonds (5.5% avg. annualized return), Bitcoin returns are astounding.

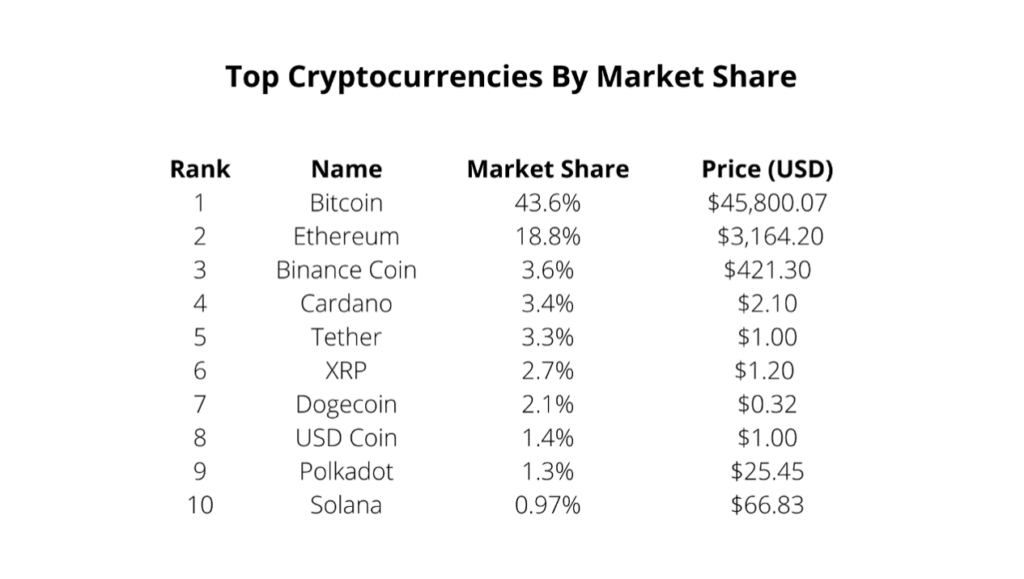

The following table depicts the top 10 cryptocurrencies being traded in the U.S. based on data as of Aug. 17, 2021.

According to a survey by The Ascent, blockchain platforms and services are projected to increase from $4 billion in 2020 to $199 billion by 2030. Bitcoin is rapidly becoming a more acceptable form of legal tender.

We are not suggesting that you run out and buy cryptocurrencies as part of your investment portfolio, this article is meant to serve as a way to help you learn more about the cryptocurrency market. As with any investment, we recommend you do your research before making any big decisions. If you have any questions or concerns, we are always here to help answer them, so give us a call at 801-465-6990!

Sources:

Amanda Agati, Daniel Brady, Rebekah M. McCahan, Jake Moloznik and John Moore. CFA

Institute. June 22, 2021. “Down the Rabbit Hole: A Cryptocurrency Primer.” https://blogs.

cfainstitute.org/investor/2021/06/22/down-the-rabbit-hole-a-cryptocurrency-primer/.

Richard Eisenberg. Forbes. June 18, 2021. “Cryptocurrency 101: All You Really Need To Know.”

https://www.forbes.com/sites/nextavenue/2021/06/18/cryptocurrency-101-all-you-really-need-

to-know/?sh=dcad1c25b533.

“Cryptocurrency Market Data.” https://www.slickcharts.com/currency.